The Equilibrium of Income in a Three-Sector Economy (3 sector income equilibrium)

Understanding income equilibrium in a three-sector economy is essential to comprehend the intricate dynamics of national income determination. In such an economy, economic activities are divided into three main sectors – households, businesses, and the government. Each sector plays a crucial role in income generation, expenditure, and allocation, ultimately influencing the equilibrium level of national income. In this article, we explore the concept of 3 sector income equilibrium, focusing on its significance.

1. The Household Sector:

The household sector represents the individual consumers in an economy who earn income through various sources, such as wages, salaries, rent, and interest. Their primary objective is to satisfy their consumption needs, which is a key driver of aggregate demand. Consumption expenditure, denoted by “C,” plays a pivotal role in determining the equilibrium level of income.

The consumption function is a critical tool in understanding the relationship between household income and expenditure. It demonstrates that as income increases, consumption also rises, albeit at a lower rate. This is due to the concept of the marginal propensity to consume (MPC), which is the change in consumption resulting from a change in income. A higher MPC implies a higher propensity to consume, leading to a greater increase in consumption as income rises.

2. The Business Sector:

The business sector comprises firms and industries engaged in producing goods and services. It is driven by the motive of profit maximization and plays a fundamental role in determining the level of investment in the economy, denoted by “I.” Investment includes capital expenditures on machinery, factories, and technology, among other productive assets.

The level of investment is influenced by several factors, such as the prevailing interest rates, business expectations, technological advancements, and the overall state of the economy. High investment levels contribute to economic growth and stimulate aggregate demand, thus influencing the equilibrium income level.

3. The Government Sector:

The government sector collects taxes and provides public goods and services to the citizens. It aims to achieve economic stability, reduce inequalities, and ensure social welfare. Government expenditure, denoted by “G,” has a direct impact on aggregate demand and, consequently, on income equilibrium.

Through fiscal policy, the government can influence economic activity by adjusting taxation and expenditure levels. During economic downturns, an expansionary fiscal policy involving increased government spending and reduced taxes can boost aggregate demand and stimulate economic growth, thus helping to attain income equilibrium.

4. Income Equilibrium in a Three-Sector Economy:

Income equilibrium is achieved when aggregate demand equals aggregate supply, implying that the total spending in the economy equals the total income generated. In a three-sector economy, this equilibrium is determined by the relationship between consumption, investment, and government expenditure.

The equilibrium condition can be expressed as follows:

Where:

C = Consumption expenditure

I = Investment expenditure

G = Government expenditure

Y = National income

For an economy to be in equilibrium, the total income earned by households (Y) must be equal to the total expenditure (C + I + G). Any discrepancy between the two would lead to adjustments in production, employment, and income levels until equilibrium is reached.

3 sector economy income equilibrium

In modern economies, government intervention is ubiquitous, and understanding its impact on income equilibrium is crucial for comprehensive economic analysis. A three-sector economy, comprising households, businesses, and the government, presents a more realistic model for studying income determination. Let us explore the significance of government spending and taxation in such an economy, focusing on the three sector economy equilibrium conditions and their implications.

1. The Three-Sector Economy:

National income (GNP) is determined in a three-sector economy by the combined expenditures of households (C), businesses (I), and the government (G), taking into consideration government spending and taxation. Consequently, the equation for national income becomes:

The introduction of government spending increases aggregate demand, whereas taxation influences disposable income and alters the spending patterns of households and businesses.

2. Equilibrium Conditions:

The fundamental equilibrium condition in this complex economy remains unchanged: aggregate demand must equal aggregate output.

Therefore:

Another equilibrium condition results from the equality of economic injections and leakages:

Where:

S = Savings

T = Taxes

If there are no tariffs imposed by the government (T = 0), the equilibrium condition simplifies to:

3. Equilibrium Income Determination (3 sector economy income equilibrium):

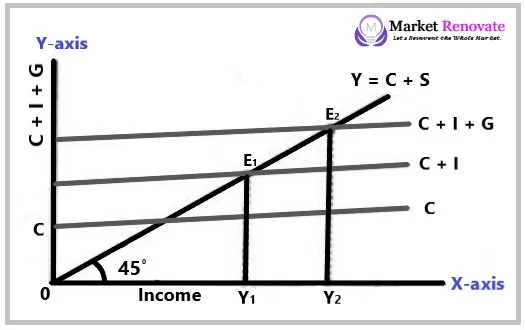

(a) When the C + I + G Line Intersects the 45° Line:

Equilibrium income is the level at which aggregate demand equals aggregate output. Graphically, it occurs at the point where the 45° line (representing output) is intersected by the C + I + G line (representing aggregate demand). The equilibrium income, denoted as Y*, is achieved when:

To help us conceptualize this concept, let’s suppose that the government spends money in a manner unrelated to how much individuals earn. Similar to how private companies invest money regardless of people’s incomes. So, we refer to these government expenditures as “autonomous (external link).”

Now, let’s examine the consumption function, which illustrates how much individuals spend in relation to their incomes. When autonomous investment is added to individual spending, the resulting line represents the total demand from households and enterprises. This line is designated as “C + I.”

When this “C + I” line is plotted on a graph and its intersection with the 45-degree line is determined, the resulting point is termed E1. This point indicates the income level at which the total demand from households and enterprises equals the total output or income. We refer to this as OY1.

Now, let’s add the government’s discretionary expenditure to the demand from households and businesses. The total demand in the economy, including government expenditure, is represented by a new line labelled “C + I + G.”

When the “C + I + G” line is plotted on the graph and its intersection with the 45-degree line is determined, a new point called E2 is obtained. This point represents the new equilibrium income level, which we refer to as OY2.

Therefore, when the government injects money into the economy through its expenditures, the result is a rise in income and an increase in employment opportunities. This demonstrates how government expenditure can significantly contribute to economic growth.

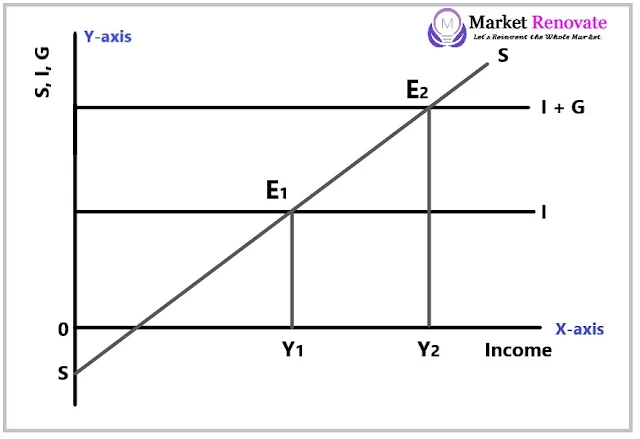

(b) Equilibrium at the Intersection of S and I + G Line:

Alternatively, equilibrium can be determined by identifying the point at which the savings (S) line intersects the I + G line. This point signifies that leakages (S) equal injections (I + G), leading to an equilibrium state.

In the above diagram, it is assumed that private investment and government expenditure occur independently and are unaffected by income levels. To illustrate this, a line dubbed the “investment line” (I) is drawn parallel to the graph’s horizontal axis. Adding autonomous government spending to this yields a new line labelled “I+G.”

The distance between the investment line (I) and the investment plus growth line (I+G) represents the volume of public investment. On the graph, the line labelled “S” (saving) and the line labelled “I + G” intersect at a point labelled E1, which represents the equilibrium level of income and is denoted by the symbol OY1.

The essential point is that an increase in government spending has the same effect on total demand and income as an increase in private investment. When the “I + G” line intersects the “S” line at a new point E2, the equilibrium level of income increases to OY2. This new income level, OY2, exceeds the original OY1 level. Consequently, when the government spends more money, the equilibrium level of income increases.

Simply put, if the government spends more money, it increases the total demand in the economy, just as private corporations investing more money do. As a consequence, the economy produces more and people’s incomes rise, resulting in a higher level of income equilibrium. This demonstrates how an increase in government spending can increase national income and economic activity.

.jpeg)

0 Comments

If this article has helped you, please leave a comment.