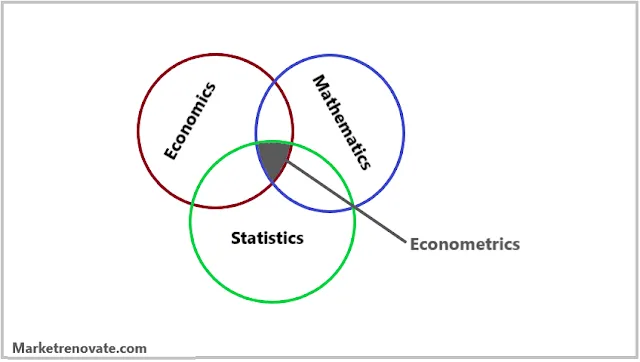

Econometrics is a fascinating discipline that combines economics, statistics, and mathematics to analyze economic phenomena. It is a relatively new field that emerged in the early 20th century and can be traced to the work of a handful of pioneering economists and statisticians. In this article, we will get into detail about the origin of econometrics, its meaning, and its definitions.

Origin of Econometrics

The term “econometrics” was coined in 1926 by the Norwegian economist Ragnar Frisch, but the origins of the field date back much further. The development of econometrics was motivated by the need to analyze economic data and test economic theories using statistical methods (Source).

Francis Edgeworth, a British economist, was an early contributor to the development of econometrics. Edgeworth used mathematical methods in his 1881 book “Mathematical Psychics” to analyze economic data and derive economic laws. In addition, he conceptualized the indifference curve, which became a cornerstone of contemporary microeconomics (Source).

Irving Fisher, an American economist, was a further influential figure in the evolution of econometrics. Fisher published “The Making of Index Numbers” in 1912, introducing the index number method for measuring changes in economic variables over time. This method is still widely employed to measure inflation and other economic indicators today.

Through their work, these early pioneers paved the way for developing modern econometrics in the 20th century. Dutch economist Jan Tinbergen was one of the central figures in this development. Tinbergen created the first econometric model in the 1930s, which analyzed the relationship between economic variables such as income, employment, and consumption using statistical methods.

Other prominent economists such as Ragnar Frisch, Cowles Commission, and Lawrence Klein soon followed Tinbergen’s work. These economists made significant contributions to econometric theory’s development and practical applications.

Meaning and Definitions of Econometrics

Econometrics can appear daunting with its combination of economics, statistics, and mathematics. However, at its most basic level, econometrics is simply the application of statistical methods to economic data to test economic theories and forecast future economic trends.

Econometrics enables economists to investigate complex economic relationships and quantify the effect of various variables on economic outcomes. While econometrics can involve complex mathematical formulas and advanced statistical techniques, its primary goal is to provide insight into the workings of the economy and assist policymakers in making sound decisions.

Econometrics is a powerful tool that allows economists to use mathematical and statistical methods to analyze economic data and test economic theories. Econometrics aims to provide insights into the complex relationships between economic variables and quantify the effects of various factors on economic outcomes.

At its core, econometrics is about using data to answer important economic questions. It entails gathering and analyzing data on economic variables such as income, prices, employment, and production and drawing meaningful conclusions using statistical methods. Econometricians model the relationships between economic variables and test economic theories using various techniques such as regression, time series, and panel data analysis.

“Econometrics is the science and art of analyzing economic data using economic theory and statistical methods.” – James Heckman

Arthur Goldberger states, “The study of statistical methods used to analyze economic data.”

The discipline of econometrics is the art of concluding imperfect data. – Angus Deaton

“Econometrics is the study and application of quantitative methods for analyzing economic phenomena.” – Christopher Sims

In the words of David Hendry, “The application of mathematical and statistical methods to analyze economic data and test economic theories is econometrics.”

Economists can use econometric analysis to forecast future economic trends and assess the impact of various policies and interventions on the economy. Economists, for example, can use data on past inflation rates and other economic indicators to forecast future inflation rates and assist policymakers in making sensible monetary policy decisions.

.jpeg)

0 Comments

If this article has helped you, please leave a comment.